Articles

The new https://happy-gambler.com/gemix-2/rtp/ handling of Function 8379 may be delayed in the event the these types of versions aren’t connected, or if the shape is unfinished whenever recorded. When you’re owed a reimbursement however, refuge’t paid certain numbers your debt, all or part of your refund may be used to shell out all of the or part of the past-owed count. Including past-owed federal tax, most other government costs (including college loans), condition income tax, kid and you will spousal assistance money, and you can condition jobless compensation debt. You might be informed if your refund your claimed could have been offset against your debts. The newest easiest and you may best way to get an income tax refund try in order to e-document and pick lead put, which safely and electronically transfers your reimburse in to debt membership.

Under copy withholding, the new payer of great interest have to withhold, because the taxation, to the matter you are paid off, by applying the right withholding speed. Withholding is required as long as you will find a condition for duplicate withholding, for example failing continually to render your TIN to your payer or failing continually to certify the TIN lower than punishment of perjury, if necessary. Element of an excellent child’s 2024 unearned money may be taxed from the the newest parent’s tax speed. If so, Mode 8615 must be finished and you may attached to the children’s taxation return.

A nine-profile income occurs when your own yearly earnings before income tax is actually anywhere between $one hundred million bucks and you can below $1 billion dollars. This may never be entirely attained while the an actual income. Alternatively, it will also through the property value other professionals anyone receives, such commodity, endorsements and also increases within the well worth on their very own money profile. Get the private coupon code USA31BONUSCODE and you can found a $31 100 percent free processor! The fresh earnings of to try out which extra are cashable, having a max cashout number of $180.

Online casinos favoritos de VegasSlotsOnline

Brand new professionals of NZ rating an excellent $step 1 deposit bonus just after register. After you subscribe Gambling Bar through an association on this site you should buy more 50 totally free revolves for $six. To the first proper currency put (merely $1) you already obtain the very first 31 totally free revolves. To get 50 totally free revolves during the Playing Bar your need put various other $5 deposit. Gaming Club contributes one hundred totally free revolves for your requirements when you become you to second deposit. It means you’ll be able to cash-out real cash immediately after to experience together with your 29 extra revolves.

How can i Get ready My Return?

However, simply their parent can be get rid of Reid while the an excellent being qualified kid. The reason being your parent’s AGI, $15,100, is over their AGI, $9,three hundred. To decide which person can also be eliminate the kid while the a good qualifying son to claim these types of five taxation advantages, the following tiebreaker laws use. To possess reason for these tiebreaker laws, the definition of “parent” function a biological otherwise adoptive parent of individuals. It doesn’t is a stepparent otherwise foster parent until that person provides followed the person. A good foster-child existed with a married couple, the fresh Smiths, the past 90 days of the year.

€/£/$1 Minimum Deposit Casinos

The 23-year-old sister, who’s a student and solitary, lifetime with you and your companion, whom provide more than half of one’s sis’s service. You and your mate is 21 years old, therefore document a combined go back. Your own cousin isn’t your being qualified man since your cousin is not young than simply your or your wife.

Worksheet 5-step 1. Calculating the expense of Group-Life insurance Relating to Money—Depicted

The following two screening must be satisfied for you to deduct people income tax. Talking about fees imposed by a foreign nation or any of the governmental subdivisions. In case your attention condition actually attending increase past these types of constraints, the newest statement ought to include this particular fact. You’re thought to reach decades 65 at the time before the 65th birthday. For lots more more information to your Roth IRAs, see chapter dos from Bar. A rollover away from a specified Roth membership can only be made to some other designated Roth membership or perhaps to a good Roth IRA.

A required debts is but one that’s of use and appropriate for your organization. A price doesn’t have to be required to meet the requirements expected. An amount isn’t really sensed magnificent otherwise elegant if it’s practical in line with the things and you may points.

To learn more, discover Possibility Zones Faq’s from the Internal revenue service.gov/Newsroom/Opportunity-Zones-Frequently-Asked-Issues. If you were granted a prize inside the identification out of successes in the religious, charity, medical, artistic, educational, literary, or civic areas, you should fundamentally through the property value the newest prize on the income. Yet not, your don’t tend to be so it prize in your income for many who see all the of your following requirements. For those who winnings a reward in the a fortunate amount attracting, tv otherwise broadcast quiz program, beauty competition, or any other enjoy, you need to are they on your earnings. Including, for many who winnings a great $50 honor within the a photographer competition, you ought to report which income for the Schedule 1 (Function 1040), line 8i. If you refuse to take on a prize, don’t were their worth on your own income.

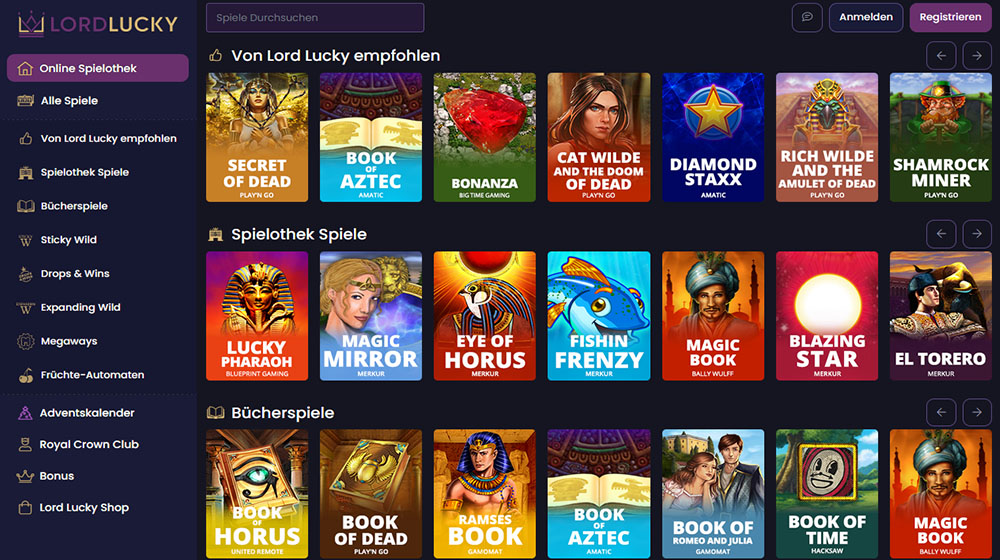

Video game assortment & software company

Almost every other earnings items briefly mentioned below are referenced to help you publications and this offer a lot more relevant suggestions. Payments from your state in order to certified visitors to lose its cost of winter season times explore aren’t taxable. The new taxation treatments for jobless benefits you receive depends on the fresh sort of system paying the pros. NIL is actually an expression one describes the fresh function through which scholar-players can receive monetary settlement.