Searching in the authorizing service individually and make contact with him or her to ascertain as to why they sent the fresh commission. The fresh Internal revenue service provides provided all the basic, 2nd and you will 3rd Financial Impact Costs. You might not any longer use the Get My personal Commission software to look at the payment condition.

A close look on the top consumer checking account campaigns

Generally, employees are laid out either less than common law or lower than regulations to own particular issues. When you have an income tax matter perhaps not responded through this book, take a look at Internal revenue service.gov and the ways to Rating Taxation Assist after it guide. https://777playslots.com/lucky-ladys-charm-deluxe/ Crisis taxation recovery can be found for these influenced by catastrophes. To find out more in the disaster recovery, see Irs.gov/DisasterTaxRelief. So it collective space allows profiles in order to contribute more information, info, and you may understanding to enhance the first deal blog post. Go ahead and share your understanding that assist fellow shoppers build informed choices.

- The firm membership your unlock should determine exactly how much incentive currency you could potentially qualify for.

- No action becomes necessary to own eligible taxpayers for these costs, which will time automatically inside December and really should get to many cases because of the late January 2025.

- Such as dumps is actually covered separately from the individual deposits of your own businesses people, stockholders, partners or players.

- The applying mainly consists of a few volunteer agreements built to improve idea money reporting because of the permitting taxpayers to know and you can meet their suggestion reporting requirements.

- Wages paid off so you can a kid under 18 focusing on a ranch that’s an only proprietorship or a collaboration in which for each mate try a pops away from a child commonly susceptible to social shelter and you can Medicare fees.

Best bank account bonuses to have Oct 2025

Which restrict applies to the fresh shared welfare of all the beneficiaries the fresh owner has called within the revocable and irrevocable faith profile at the exact same lender. “Self-directed” implies that bundle players feel the straight to head how cash is invested, such as the capacity to head you to dumps be put from the a keen FDIC-covered lender. So it part means the following FDIC ownership classes and the standards a good depositor need to satisfy to qualify for insurance more than $250,000 from the you to definitely covered lender. The newest FDIC ensures deposits that a person holds in a single covered bank independently out of one dumps your individual owns an additional on their own chartered covered bank. Including, if one have a certification from deposit from the Lender A great possesses a certification away from deposit from the Bank B, the fresh profile manage for each and every end up being insured separately to $250,100. Money deposited within the separate branches of the identical insured financial try not on their own insured.

High-produce discounts profile: Advantages and disadvantages

A worker included in a keen HDHP and you can a health FSA otherwise an HRA you to definitely will pay otherwise reimburses licensed medical expenditures can also be’t basically build contributions to help you an HSA. A keen HDHP may possibly provide precautionary proper care benefits as opposed to a allowable or that have a good deductible lower than the minimum annual allowable. Precautionary proper care includes, but isn’t restricted to, the following. For many who see such requirements, you’re a qualified personal even if your lady have non-HDHP members of the family publicity, provided your spouse’s visibility doesn’t defense your.

✔ Beginning numerous membership

If you are searching for FDIC put insurance coverage, simply be certain that you’re placing the finance within the in initial deposit tool during the bank. Because the 1933, the newest FDIC secure has displayed the protection and protection in our country’s creditors. FDIC put insurance enables people in order to with confidence put their cash in the a large number of FDIC insured banking institutions nationwide, and that is backed by a complete faith and you may borrowing of one’s Us government. Deposit insurance covers depositors up against the failure away from an insured bank; it generally does not prevent losings due to thieves otherwise fraud, that are treated because of the most other laws and regulations.

If you use a premium preparer to accomplish Mode 945, the new paid preparer must complete and you will signal the newest paid preparer’s section of the setting. On the newest information about developments linked to Form 945 and their recommendations, such as regulations enacted once they have been composed, visit Internal revenue service.gov/Form945. Of numerous, or all the, of your points searched in this article come from our adverts people just who make up all of us when taking certain steps to the our very own webpages otherwise mouse click to take a task on their site.

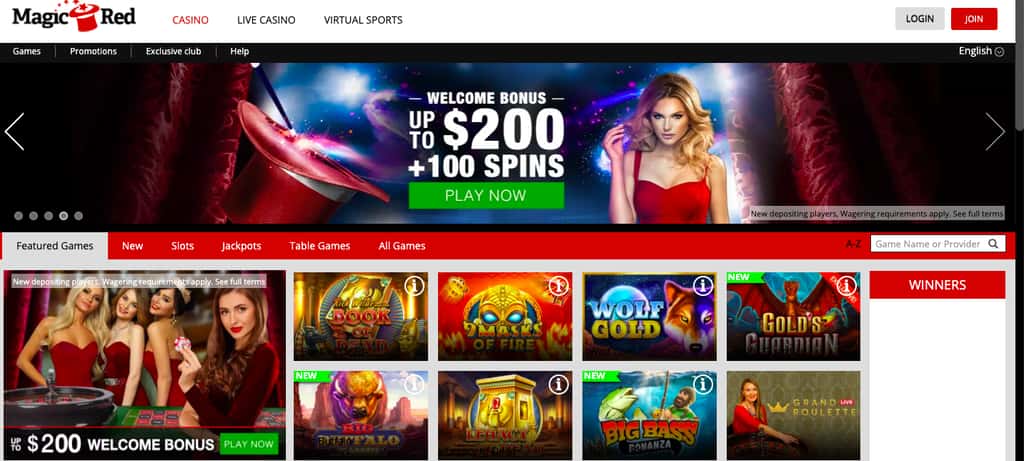

How to find dependable no deposit bonuses

You may also claim an overpayment (the sum of outlines 70a and you can 70b) since the a reimbursement otherwise a credit. Read the relevant container on the internet 71 to show what type you are claiming. For individuals who allege a card, it will decrease your necessary places out of withheld income tax to possess 2025. Remember that if you paid back the brand new individual overwithheld amounts once year-stop 2024 with the reimbursement or place‐out of actions, you aren’t capable allege a reimbursement to own such an matter for the 2024 Form 1042. As an alternative, you must indicate online 71 that you will be claiming a good credit to be used on the new 2025 calendar year. If you’re unable to begin in initial deposit exchange to your EFTPS from the 8 p.m.

Your staff might not foot its withholding amounts to the a predetermined dollar matter or fee. But not, a member of staff will get indicate a buck total getting withheld for each pay several months as well as the amount of withholding according to submitting position or any other information stated to your Form W-cuatro. Costs so you can staff to possess characteristics regarding the apply of condition and state companies are usually at the mercy of federal taxation withholding although not FUTA income tax. Most chose and designated social authorities out of condition otherwise local governing bodies is actually staff below popular-law laws.